What Is A Managed Services Customer Actually Worth?

Before you spend a penny on sales and marketing for your Managed Services company, you should first understand what it is you are “buying.” Knowing what a customer is worth and how much you can afford to pay to acquire one is the single most important part of growing your company. Without knowing these numbers, you may be spending too much (or not enough) to acquire a new customer. What I find to be common is for Managed Service Providers to have a sales & marketing formula that is working, yet due to shortsightedness they fail to recognize it (and thus restrict spending). All this really does is postpone their growth and possibly risks the window of opportunity closing.

Anyone on the front line battling internet algorithms for ad spend knows that when something works, you have to bet big. Returns can diminish in the blink of an eye with one meaningless update and if you fail to capitalize before they do, the opportunity can be lost forever. Forecasting can help you make sound decisions even when acting in haste to capitalize on lead generation opportunities of the moment. To help you understand how much profit a customer can generate over its lifetime and how much you should spend to acquire them, here is a crash course on assessing the Lifetime Value (LTV) and Target Acquisition Costs (TAC) of Managed Services customers.

How To Calculate Lifetime Value (LTV)

The actual math involved with calculating the LTV of a customer is rather simple. The formula that we use looks like this:

LTV = (MRR x Endpoints) x (Months Retained) x (Profit %)

Some people may calculate this a different way, however this is the formula that was simplest to understand and worked best for us in evaluating our own customers. Keep in mind that the idea is to create a projection. The important part is going through this evaluation process and tweaking your numbers as you go, to best replicate your actual outcomes.

To dive a little deeper into this formula we will break this down into sections starting with (MRR x Endpoints). The first part of the equation is to figure out what your average Monthly Recurring Rate is and multiply it by the number of endpoints the customer has. For example, if a customer pays $100 per month per endpoint and they have 25 endpoints then it can be assumed that this customer generates $2500 per month in revenue. Here is how this will look in our formula.

LTV = ($2500) x (Months Retained) x (Profit %)

The next section of the formula (Month Retained) projects the number of months you expect to retain the customer. Since retention in Managed IT is very high, this number can be difficult to forecast. In our case, we used a 5 year period (60 months) which included the initial 3 year contract of the customer and then two years of annual contract renewals. If you only offer single year contracts then your retention may be slightly lower, however I think most Managed Services Providers would agree that five years is an accurate projection. Here is how our formula looks as we update the next section.

LTV = ($2500) x (60) x (Profit %)

The final part of our formula (Profit %) to estimate the profit margin you can expect on the customer. If you are unsure how to get to this figure, the formula is this: (Endpoint MRR – Endpoint Cost) / Endpoint MRR = Profit %. We do not include acquisition costs, since we are ultimately trying to figure how much our sales and marketing costs should be.

It is best to come up with an average profit margin of your existing customer base and then use that number in your overall projection. Putting our example through this formula looks like this: ($100 – $80) / $100 = 20% Profit Margin

$30,000 = ($2500) x (60) x (.20)

Through this exercise we have now determined that a customer that has 25 endpoints and pays $100 MRR will generate roughly $30,000 over its lifetime.

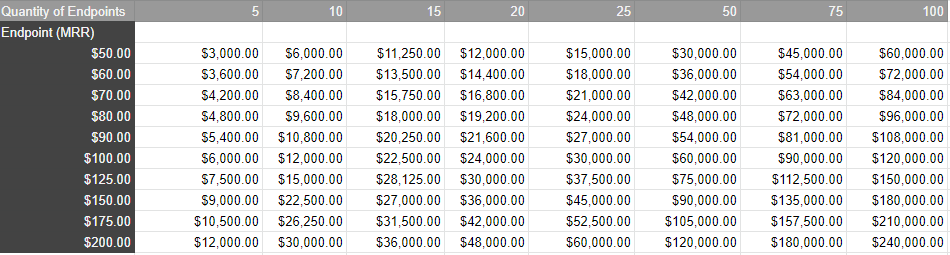

To give you some perspective on how the LTV can vary based on endpoint price and number of endpoints, here is a table that shows a wide range of pricing. This table assumes a 20% profit margin before acquisition costs and a 5 year retention.

Lifetime Customer Value (Table)

The Ultimate Guide To Cash Flow For Managed Services

Sponsored by Alternative Payments & Zest

Determining Target Acquisition Costs (TAC)

Now that you know how to calculate the Lifetime Value of your customer, you can use this information to create a Target Acquisition Cost (TAC). When acquiring a new IT customer, you should look to keep your marketing expense under 20% of the Lifetime Value that said customer will bring. That formula looks like this:

TAC = (LTV) x (0.20)

To revisit our example from the previous section, the math indicates that you should not spend more than $6,000 to acquire a customer with a Lifetime Value of $30,000. Here is how that calculation looks in our TAC formula:

$6,000 = ($30,000) x (0.20)

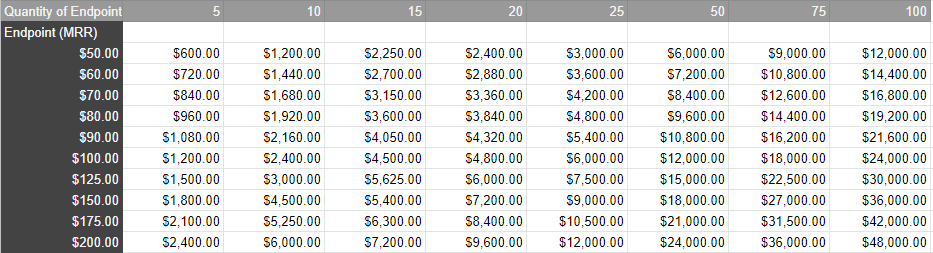

Remember the table we created to show you the LTV across a wide range of endpoints and costs? Here is the same table, but now showing the TACs for those same projected figures.

Target Acquisition Cost (Table)

TAC (Table): Assumes 20% Profit Margin Before Acquisition Cost + 5 year Retention + 20% Acquisition Cost

The Ultimate Guide To Cash Flow For Managed Services

Sponsored by Alternative Payments & Zest

Actionable Ways To Use LTV & TAC

Stats like Lifetime Value and Target Acquisition Cost are only valuable if you can take action from them. Here are a few examples of how you can use these projections to make better decisions while growing your Managed Services Business.

Marketing Budget

When spending money on marketing, the most natural instinct is to set a budget. I am not going to imply that budgets are bad, but sometimes they can hinder growth beyond repair. If your marketing is actually working and you are acquiring customers below your TAC, shouldn’t you spend as much money as you can get your hands on? In a different context, if someone was selling you $20 bills for $10, would you set a “budget” or would you just drain your bank account buying as many as possible? Only after calculating LTV and TAC can you determine whether you need a “budget” or if you should spend as much as cash flow allows, achieving accelerated compounding growth.

Lead Optimization

Another way to use LTV and TAC is in developing your target audience for lead generation campaigns. Let’s say that it costs you roughly $250 to generate a lead through LinkedIn ads. You find that on average you only close 5% of these leads which means that your Acquisition Cost on this platform is roughly $5,000. Using our TAC table, you can make the determination that you only want to target companies with 25 or more endpoints, ensuring that the leads you do get have an LTV high enough to meet your TAC. This allows you to make informed decisions when refining your campaigns to ensure that the leads you get are guaranteed to produce a net positive return.

Sales Quotes

When going up against another provider you can use LTV in making the decision of how low you can price your services to win the deal. For example, let’s say there is a 100 endpoint Non-Profit company that you have quoted and have been nurturing for a few months. You are up against five other providers that have also submitted quotes and it appears that the lowest price will win the deal. If you have already invested $15,000 in marketing expenses to generate the opportunity, how much can you afford to drop your price to close the deal? If your average profit margin was 20% before acquisition (like our table) you could go as low as $70 per endpoint. This is very valuable information to have when quoting high value contracts.

Conclusion

While the math can be a little challenging at first, calculating your LTV and TAC is the first step in creating a successful growth plan for your Managed Services company. Once you have a model that accurately depicts your company’s average profit margin and customer retention, you can make decisions faster and without hesitation. If you are like many of the MSPs that get “cold feet” the second they have to shell out for marketing expenses, this could be exactly what you need to stay on course and see campaigns through to completion. You will probably even find yourself wondering how you have ever made sales and marketing decisions without it.

SPONSORED BY ZEST