IT-Related Search Volumes Have Normalized. Are MSPs Better Off?

Back in the month of May, we put together a list of the IT-related search terms that were seeing an incredible amount of growth due to Covid-19. This data was sourced from Google Trends and compared to important milestones that we proved to have had an impact in driving demand for IT during this time.

It is now August and unfortunately the virus is still here but the growth has now waned. Our hunch was that the window of opportunity has likely closed (for now) and that the next wave of demand would likely occur sometime in the next few months. Now feels like the perfect time to revisit this list and find out where MSPs stand compared to pre-pandemic levels and whether or not long term demand will prevail.

We were pleasantly surprised for some and disappointed for others, but ultimately this what we learned when circling back through the same trends that we shed light on several months ago:

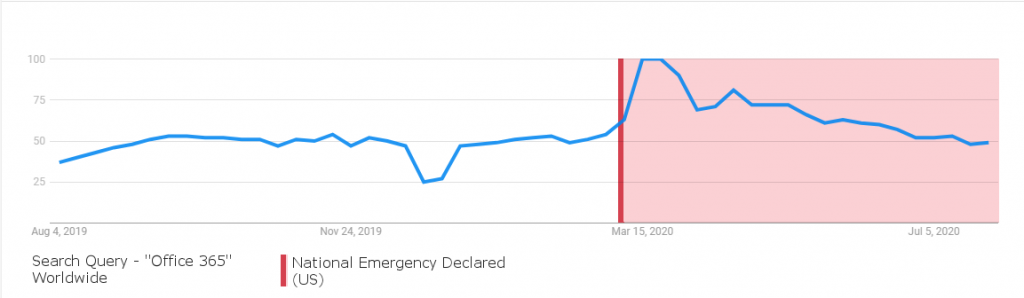

Search Term – “Office 365”

The immediate growth in demand related to Office 365 in March was likely on the back of Microsoft Teams. Unlike a few of the other trends we have seen, this was immediate, with interest nearly doubling upon stay-at-home orders in the US. Since that time, interest has appeared to slowly decline, now settling at roughly the same levels that it was at prior to the pandemic. One notable item to look at is that last July and August saw substantial dips in interest, which may explain some of the decline that has happened in recent weeks. This is a sign that an October comeback may be in the works.

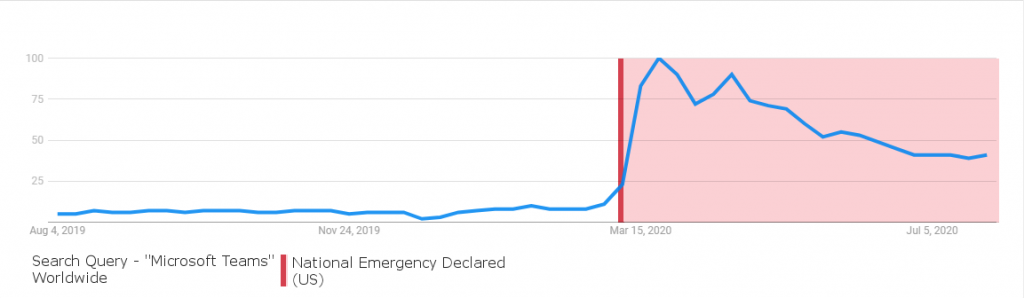

Search Term – “Microsoft Teams”

As we pointed out in our first piece back in May, Microsoft Teams was the clear winner in the pandemic tech boom. It has now been reported that usage grew 894% between the months of February and June. These search trends certainly tell a similar story and while they appear to be sliding back down on a consistent basis, the plateau appears to be laying at roughly 10x its 2019 average. This indicates that the growth is here to stay and the upcoming end-of-support for Skype for Business is an insurance policy against future decline.

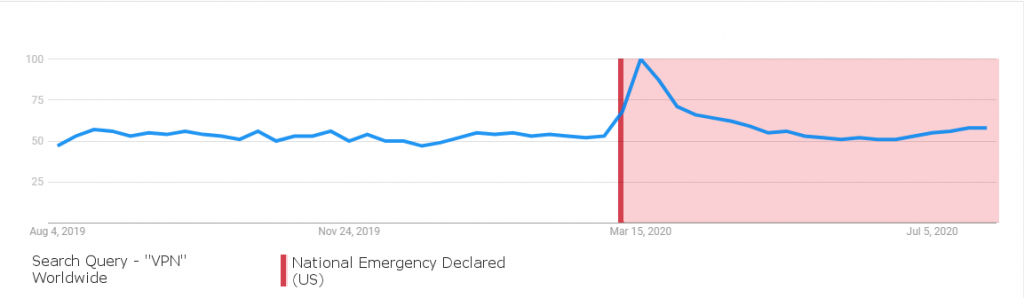

Search Term – “VPN”

What has been interesting about the spike in interest for VPNs was the somewhat immediate crash back down to normal volumes . Even more peculiar is the uptick in growth over the last month which was a interesting trend compared to others that I researched. My immediate thought was that summer travel in the northern hemisphere and the threat of banning TikTok could have an impact on this recent growth. This is one that is certainly worth keeping an eye on to rebound in the coming months.

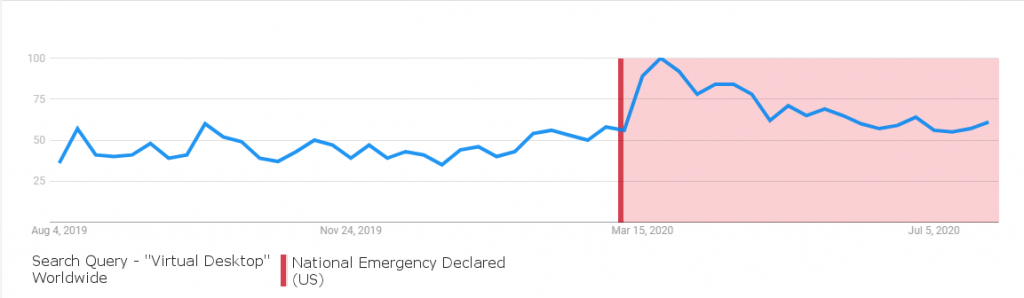

Search Term – “Virtual Desktop”

If MSPs are looking for a growth area that will translate to high earning potential, virtual desktops are it. While the immediate pandemic growth was not as dramatic as some of the others that we identified, it still nearly doubled normal volumes at its peak. What is most impressive has been that the decline is somewhat gradual, indicating that there is still plenty of opportunity to be had in the next few months moving forward.

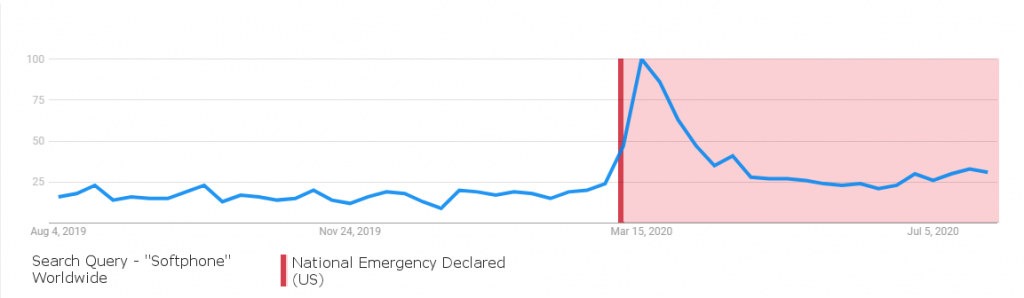

Search Term – “Softphone”

The future of on-premise phone systems is in question as many office spaces have been semi-permanently shuttered until further notice. This has created substantial opportunity surrounding VoIP and softphone applications that allow for call routing through workstations and mobile phones. Despite the dramatic rise (then fall) of this search query, one would think that as long as remote work continues trending upward, cloud and software-based communication systems will continue to move with it.

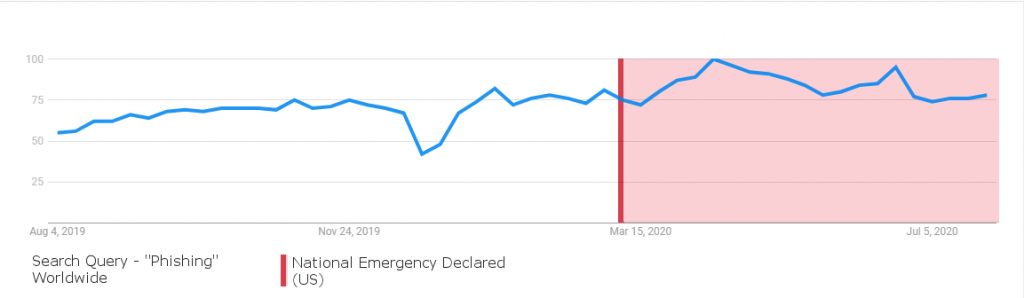

Search Term – “Phishing”

Of all of the queries that we researched, the topic of phishing was one of the only queries that nearly peaked on two separate occasions over the past few months. The first peak was quite obviously tied to phishing schemes surrounding government stimulus checks, however the second peak in the middle of May was not so obvious. Based on the news articles and government alerts put out at this time, we believe this second peak could have been attributed to the sale of phony test kits but that is more speculation than it is fact.

The Ultimate Guide To Cash Flow For Managed Services

Sponsored by Alternative Payments & Zest

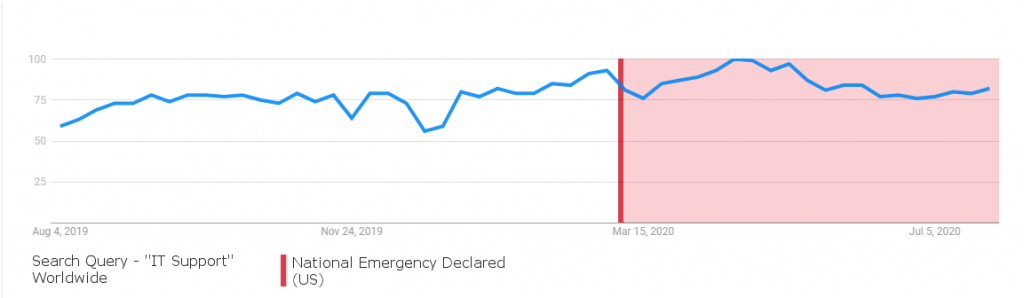

Search Term – “IT Support”

As I mentioned in the last piece on this topic, vague and generic terms such as “IT Support” should come in at high enough volumes to offset any volatility that may occur, even from events as impactful as this pandemic. This held true, as a surprising dip was followed by record high volumes in the months of April and May. The most significant part of this pattern is that August appears to be trending back upward, which is another example of opposite behavior from 2019 when visible dips occurred.

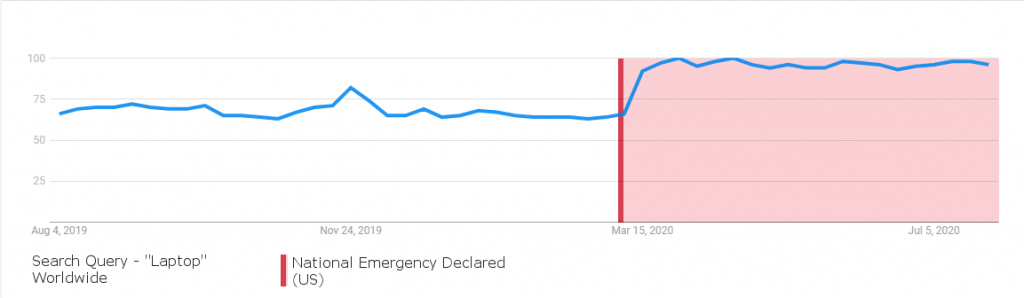

Search Term – “Laptop”

The most reliable growth of any of the terms that were researched appeared to be related to key work-from-home hardware and software components. The most important of these (the laptop) has held its peak for almost four months with very little decline. There has been much speculation about whether or not work-from-home will continue when things go back to normal, but in my opinion, the consistent investment into laptops at this magnitude proves that businesses are truly committed to unplugging from their physical space.

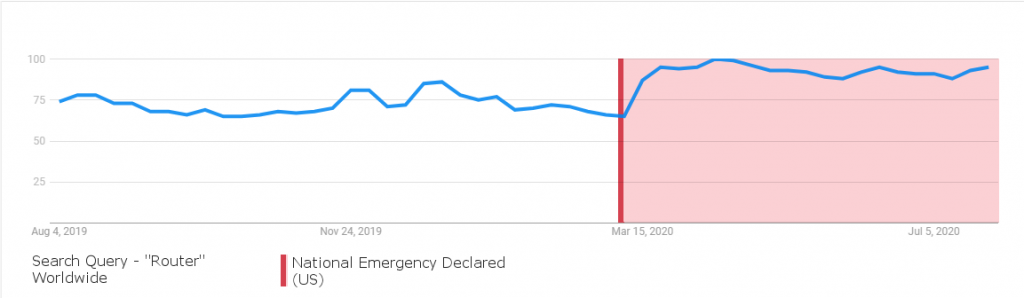

Search Term – “Router”

Another key component of the “WFH kit” (the router) is seeing similar stability and settling in at a new plateau. Whether or not companies are willing to invest in business grade hardware for their employee’s home networks is to be determined, but there appears to be a high level of interest in this category of products none-the-less. As I mentioned before, even if this doesn’t translate directly to revenue for an MSP, leveraging this hot topic (and others mentioned) within your content and marketing campaigns can help draw more audience members into your funnel at a time when it is difficult to do so.

SPONSORED BY ZEST