Increase Your MSP’s Quantity and Quality of Referred Leads

If you are one of the many Managed Services companies in the industry that suffers from poor cash flow, then you may not have the funds available for lead generation. While there are a lot of great vendors that offer these services, they often require a minimum commitment of several thousand dollars per month for at least six months and ultimately the results are never guaranteed. To be fair to such vendors, this cost is completely justified. The value of an IT customer as we have previously calculated is substantially more than they are ultimately charging to generate them. This means that the MSPs who are able to stomach the expense the longest, tend to see the best results.

But what about those MSPs who can’t afford this type of expense? Some must rely solely on referrals to generate new business while they work to improve their cash availability. For Providers in this position, here is our strategy for taking an aggressive approach to customer referrals, getting new business funneling in without the risk of an upfront expense.

Why Customers Don’t Refer New Business

To get customers to refer you new business, you must first understand why they have already failed to do so. The psychology behind a customer referral is actually quite interesting. When someone refers their friend to a product or service, they are likely doing so for their own social benefit. Whether they want to be looked at as an “expert” having inside information, or simply want to do a favor hoping to get something in return, the referrer likely sees themselves as the beneficiary and not the other way around as you would think.

When customers decide not to refer business, it is because the risk is too high for the reward (social benefit) they will receive. Not every one of your customers has had the perfect experience with your company and over time this builds up a risk profile in your customer’s mind. If a customer sees an opportunity to refer your company in a social setting but doesn’t, it is likely because the social benefit for them doing so is simply not worth it. This is where an incentive plan comes in. Turning a social benefit into a tangible monetary benefit now increases the value of the reward, making the risk significantly more tolerable. Customers can now refer freely, knowing that what they get in return is substantial enough to stick their neck out for you.

The Ultimate Guide To Cash Flow For Managed Services

Sponsored by Alternative Payments & Zest

Creating A Referral Incentive Plan

When you have received referrals for free in exchange for offering exceptional service, I can understand why suddenly paying for these referrals is hard to understand. The objective of using this strategy is not only to increase the number of referrals you receive but also increasing the quality of referrals. This is done by creating a system where customers who refer high quality customers get a more substantial reward. It also ensures that the math will always work in your favor.

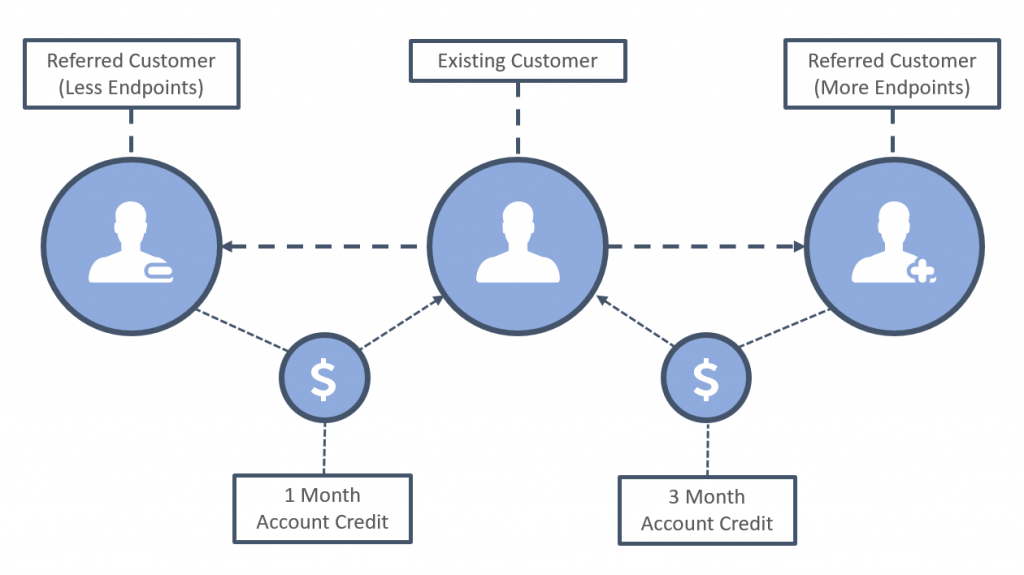

Here is an example of a referral incentive plan that you can implement immediately that will prompt your customers to send you quality leads often.

Referral Incentive Plan

- Customers who refer you new business that closes will receive an account credit toward their invoice.

- If the referred customer has a lower quantity of endpoints than the referring customer, the credit is worth one month of the referring customer’s total MRR (a month of free service).

- If the referred customer has the same or higher quantity of endpoints than the referring customer, the credit is worth three months of the referring customer’s total MRR (three months of free service).

- Customers who refer you new business that doesn’t close will receive a small gift card or account credit as a “thank you anyway.”

Before you blow a gasket at the thought of giving away an entire quarter of free service, let’s look at the numbers to explain why this actually works.

Structuring Incentives For Stable Revenue

An important part of putting together this program is structuring it in a way that is cash-flow friendly. For this reason, you should begin applying the customer account credits on the same billing cycle that the first bill is sent to your new customer. This ensures that there is little to no drop off in revenue and in most cases your revenue should still increase as you on-board the new customer. This is important not only for financial measurements, but also from an accounts receivable standpoint.

The Ultimate Guide To Cash Flow For Managed Services

Sponsored by Alternative Payments & Zest

Understanding Your Acquisition Costs

Even though your revenue is likely to remain the same in the short-term, your cost will increase. The acquisition cost for such deal will be the equivalent of your COGS (cost of goods sold) expenses for either a month or three month period. If you have a 20% profit margin, this means that your acquisition cost would equal 80% of your existing customer’s MRR.

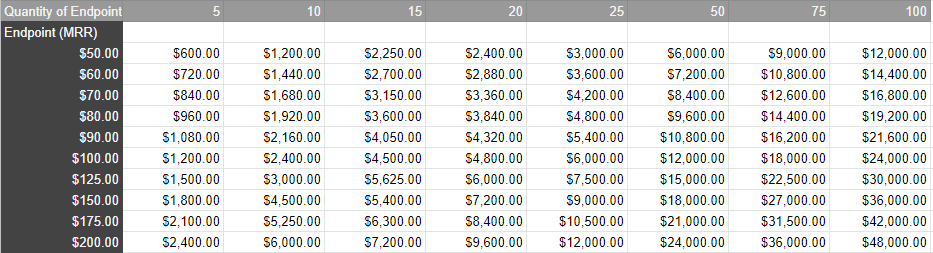

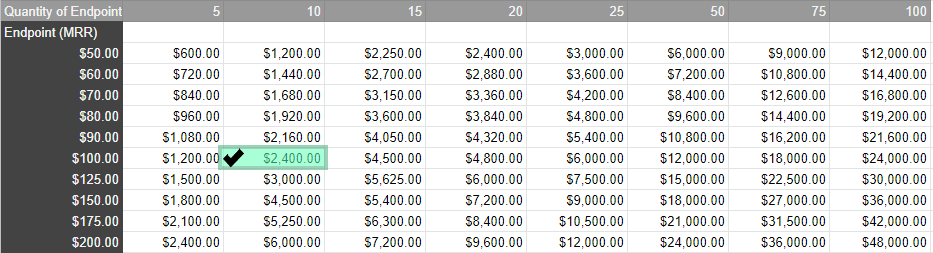

Using our TAC (Target Acquistion Cost) table from our article on Liftetime Value we can determine how our referral incentive program stacks up against traditional advertising and lead generation costs.

For those of you who are new to Lifetime Value, be sure to check out this article to understand how these numbers are calculated. In short, the Target Acquisition Cost below is equivalent to 20% of the profit a customer will generate over its lifetime.

Target Acquisition Costs (Table)

TAC Table: Assumes a 20% Profit Margin and a 5 Year Customer Retention.

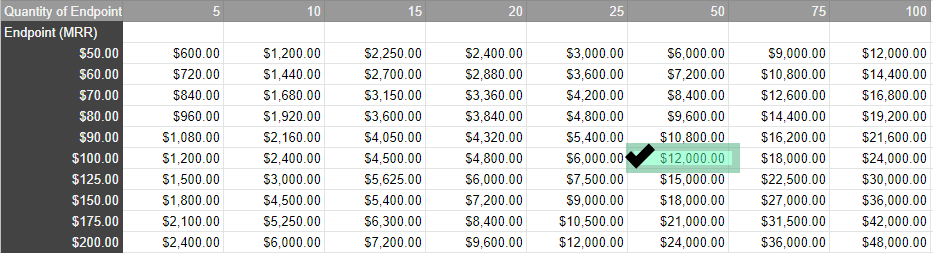

Let’s use the example of an existing customer that has 25 endpoints and pays $100 per seat.

If they were to refer you a new customer that has 50 endpoints (also at $100 per endpoint) and received a three month account credit, your acquisition cost would be $6,000. This is half of our Target Acquisition Cost ($12,000) of said customer according to our table, making this a substantial value.

Highlighting 50 Endpoint Target Acquisition Cost: Assumes a 20% Profit Margin and a 5 Year Retention.

If the same existing customer also referred a new customer with 10 endpoints (also at $100 per endpoint) and receive a one month account credit, your acquisition cost would be $2,000. This is still less than our Target Acquisition Cost ($2,4000) of said new customer according to our table, making this another great value.

Highlighting 10 Endpoint Target Acquisition Cost: Assumes a 20% Profit Margin and a 5 Year Retention.

Removing Your Risk

As you can see by our calculations, the costs of acquiring these customers are somewhat substantial, however the math will work in your favor almost every time. The biggest benefit of using this method is that there is little to no risk on your side. Your large expenses are only paid if and when you acquire a new customer. This is contrary to other forms of marketing where you must put out substantial funds up front, generate leads, and then wait through a long sales cycle before you see a return on your investment.

While I am not an advocate for acquiring customers only by referrals, I believe that every Managed IT Company should take an offensive approach to producing them. This is especially true for those Providers that have found themselves stuck in a slow growth phase with little capital available.

SPONSORED BY ZEST